Introduction: Access to quick, transparent credit is a key enabler for micro-entrepreneurs, gig workers and salaried individuals. Digital Credit Scheme 2.0 refers to modern digital lending programs backed by stronger consumer protection and streamlined online workflows. This article gives a practical, step-by-step walkthrough of the application process, required documents, timelines and actionable tips to improve approval chances.

What is the Digital Credit Scheme 2.0?

Digital Credit Scheme 2.0 denotes the second-generation digital credit offerings delivered through regulated digital lending platforms and financial institutions. These schemes combine:

- Online KYC and Aadhaar-based verification,

- Automated credit decisioning using bank statements and digital data,

- Transparent disclosures of interest, fees and recovery methods, and

- Faster disbursal directly to the borrower’s bank account.

The aim is to expand credit access while protecting borrower rights and reducing friction.

Who Can Apply? — Eligibility Criteria

Eligibility may differ by implementing agency, lender or scheme variant. Common eligibility points include:

- Resident of India aged 18 years or older.

- Valid identity (Aadhaar/PAN) and address proof.

- Active bank account in the applicant’s name.

- Stable income (salary, business turnover, or alternative income evidence).

- No major defaults listed in credit bureau records.

- If an MSME/micro-enterprise applicant — business registration (Udyam or equivalent) may be requested.

Required Documents (digital copies)

Prepare the following digital documents to speed up the online application:

- Identity proof: Aadhaar card, PAN card (digital copies allowed).

- Address proof: Utility bill, bank statement, or Aadhaar.

- Bank statements: Last 3–6 months (for salary and cash flow verification).

- Business documents: Udyam registration, GST certificate or invoices (for enterprises).

- Income proof: Salary slips, ITR returns, profit & loss summary (if available).

- Passport photo: Recent image for the digital profile.

Tip: Convert scanned docs to PDF or high-quality JPG (file size limits vary by portal).

Step-by-Step Application Process

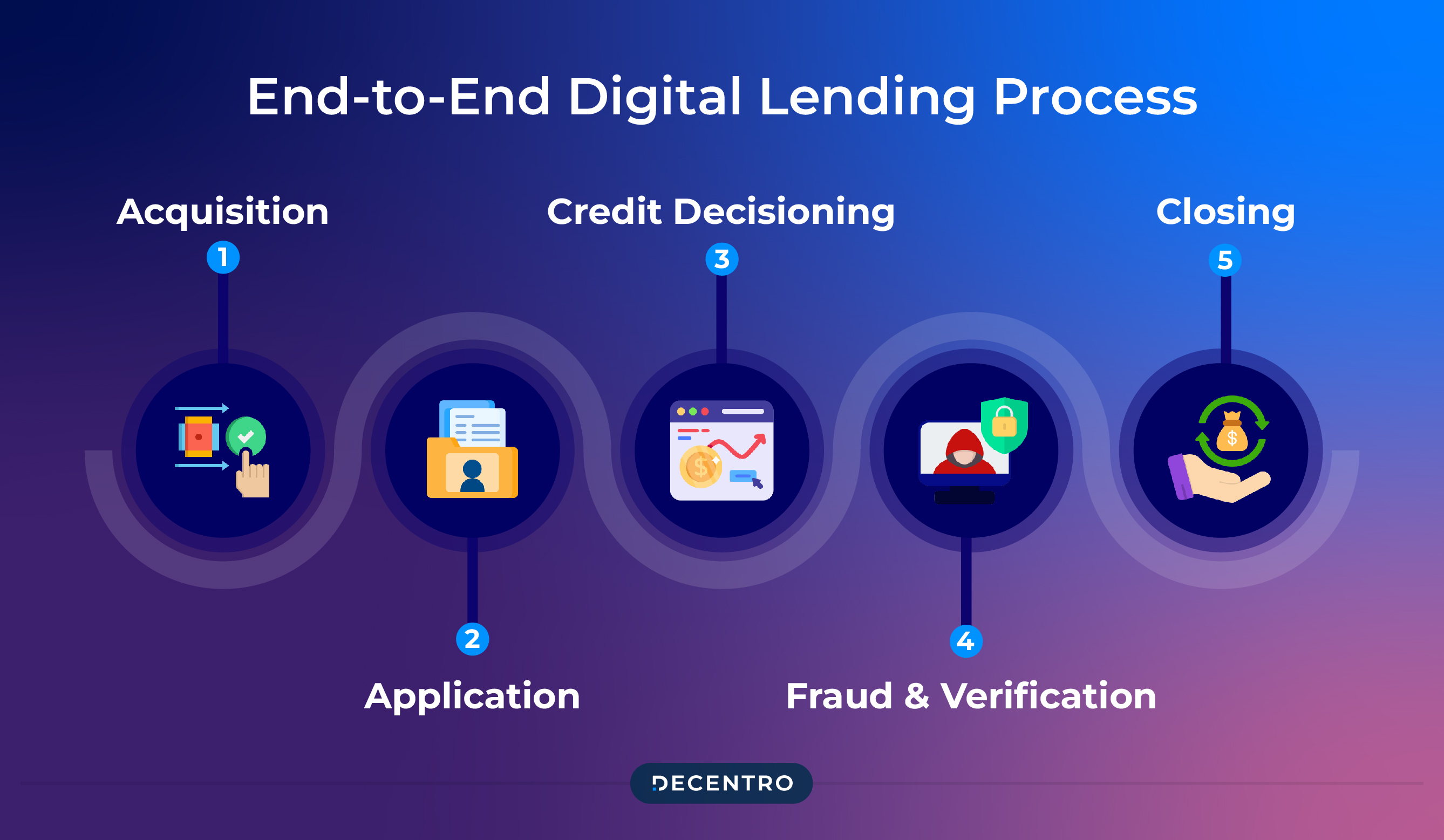

Below is a typical online flow you will encounter when applying for Digital Credit Scheme 2.0.

1. Visit official portal or lender app

Open the scheme's official web portal or download the lender’s mobile app. Use the published URL or verified app store listing to avoid phishing. Create an account using your mobile number and email.

2. Basic registration & pre-screening

Enter basic details (name, contact, Aadhaar/PAN). Many portals provide an instant pre-screen check where you input income and business turnover to see preliminary eligibility.

3. Fill the detailed application

Complete the application with:

- Loan amount requested and intended tenure;

- Purpose of funds (working capital, equipment, expansion, personal emergency);

- Bank account details for disbursal and auto-debit setup;

- Upload scanned documents as requested.

4. e-KYC and digital verification

The platform will perform e-KYC (Aadhaar OTP or biometric), PAN verification and bank validation (via OTP). Ensure your mobile number is linked to Aadhaar and your bank account for a smooth process.

5. Automated credit assessment

Digital lenders use algorithms to analyse bank statements, transaction patterns, credit bureau history and alternative data (e-commerce or utility payments). This underwriting decides sanction limits and interest rates.

6. Sanction, acceptance & disbursal

If approved, you'll receive a digital sanction letter with all terms: principal, interest rate (or APR), tenure, EMIs, processing fees and prepayment penalties. After accepting terms (often by e-consent), funds are disbursed to your bank account.

7. Repayment & account management

EMIs will typically be debited automatically (auto-debit/mandate). Use the lender’s app or web portal to track outstanding balance, payment schedule and to download statements.

Key Advantages of Digital Credit Scheme 2.0

- Speed: Faster approvals and disbursal thanks to automation.

- Convenience: Entirely online process with e-KYC and digital signatures.

- Transparency: Clear APR disclosure and documented recovery methods.

- Inclusion: Wider reach to micro-enterprises and gig economy workers.

- Lower operational cost: Reduced processing overhead sometimes lowers fees.

Common Pitfalls & How to Avoid Them

- Document mismatches: Name mismatches across Aadhaar, PAN and bank account lead to rejections. Fix: Correct documents before applying.

- Poor credit history: Defaults reduce approval chances. Fix: Clear dues, and if errors exist, raise disputes with bureaus.

- Applying to many lenders: Multiple simultaneous inquiries may hurt your score. Fix: Apply selectively and check pre-qualified offers first.

- Ignoring digital consent steps: Not completing e-signature or mandate will stall disbursal. Fix: Follow app prompts; keep your phone handy for OTPs.

Typical Timeline (estimate)

Actual timings vary by lender and complexity; a typical end-to-end timeline might be:

- Day 0–1: Registration & pre-screening;

- Day 1–2: Document upload & e-KYC;

- Day 2–4: Credit assessment & sanction;

- Day 4–5: Disbursal (post acceptance).

If any step requires manual verification (unusual documents, complex business accounts) the timeline may be longer.

Digital Compliance & Borrower Rights

Digital lending is subject to consumer protection norms. Key points to expect from a compliant lender:

- Plain-language disclosure of interest rate (APR), processing fee and total cost of credit;

- No unauthorized deductions from your account — mandates must be pre-approved;

- Access to a grievance redressal mechanism and contact details for complaint escalation;

- Clear identification of any recovery agents and their code of conduct.

Tips to Improve Your Approval Chances

- Keep 3–6 months of clean bank statements showing steady inflows.

- Ensure Aadhaar, PAN and bank account names match exactly.

- Register your MSME or maintain simple turnover records for business loans.

- Aim for a loan amount aligned with your current cashflow; smaller requests often face less scrutiny.

- Respond quickly to lender queries and complete e-mandates promptly.

FAQs — Frequently Asked Questions

Is collateral required under Digital Credit Scheme 2.0?

Most digital credit offerings are unsecured for smaller ticket sizes. Higher amounts may require additional security depending on the lender’s policy.

Can I apply completely via mobile?

Yes — most platforms support full mobile application, e-KYC and document upload. Use only verified apps from official app stores.

What happens if I miss an EMI?

Missed payments may attract late fees and affect your credit score. Contact the lender immediately — some lenders offer repayment restructuring or a moratorium in genuine hardship cases.

How is Digital Credit Scheme 2.0 different from a traditional bank loan?

Primary differences are speed, reduced paperwork, fully digital underwriting and often smaller loan ticket sizes tailored for immediate needs.

Conclusion

Digital Credit Scheme 2.0 streamlines access to small and medium digital loans through online underwriting, faster disbursals and clearer borrower protections. By preparing documents, matching identity details across records, and applying prudently, you can make the application process smooth and increase the probability of approval. Use digital credit responsibly — borrow only what you can repay, and monitor your repayments through the lender’s portal to maintain a healthy credit profile.

0 टिप्पणियाँ